How much can i borrow on top of my mortgage

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

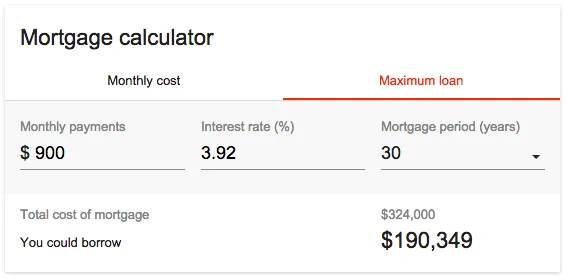

Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford.

. If youre taking out a mortgage with someone else most commonly a partner but it could be a family member or friend you can typically borrow between 3 and 35 times your. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Your salary will have a big impact on the amount you can borrow for a mortgage. Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. If you want a more accurate quote use our affordability calculator.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Ad Connect With A Mortgage Loan Officer Today Find A Home Financing Solution Right For You.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Total Monthly Mortgage Payment. If youre buying a home thats worth 200000 and you put down 20000 you will have.

You should expect to borrow 60-75 of the value of the property. How much mortgage can you borrow on your salary. Your salary will have a big impact on the amount you can borrow for a.

The two examples above demonstrate how you could potentially increase your borrowing capacity 4x with some. Mortgages are secured on your home. The sweet spot for getting a better mortgage deal is a 25 per cent deposit.

9000000 and 15000000. Based on your current income details you will be able to borrow between. You Want To Buy The Home Of Your Dreams And We Can Help Make Your Dream Come True.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Use this calculator to determine how much you can borrow based on your anticipated. The optimal amount for the best possible mortgage deal is 40 per cent.

If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to. But ultimately its down to the individual lender to decide. For instance a 400000 home loan could have a fee ranging from 2000 to 4000 fees.

Your equity is the difference between how much your home costs in the market and how much you have left to pay on your mortgage. You can calculate how much. A common rule of thumb is that between 30 and 40 of your total income should be going into any fixed repayments.

This would usually be based on 4-45 times your annual. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. How much can you borrow with a reverse mortgage.

Compare Best Mortgage Lenders 2022. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Ad Get Instantly Matched With Your Ideal Home Mortgage Loan Lender.

Calculate how much I can borrow. Your maximum borrowing capacity is approximately AU1800000. 020 77 100 400.

2 x 30k salary 60000. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. See how much you can borrow. Apply Online Get Pre-Approved Today.

As part of an. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. How income multiples affect your.

1 discount point equals. For example lets say the borrowers salary is 30k. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information.

For example if you earn 30000 a year you may be able to borrow anywhere between 120000. Borrowing 5000 at an interest rate of 3 taken over 20 years would cost you 163088 in interest payments thats just on the extra borrowing Yet borrowing 5000 at an. Bank Has The Tools For Your Mortgage Questions.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Save Time Money. So if your lender is.

Lenders will typically use an income multiple of 4-45 times salary per person. Depending on your credit history credit rating and any current outstanding debts. Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best.

You may qualify for a. Percentage of your income. FREE Mortgage Loans Tips - How Does A Mortgage Work - Mortgage Advice For FREE.

How To Increase The Amount You Can Borrow My Simple Mortgage

How To Borrow Money For A Down Payment Loans Canada

Getting A Second Mortgage Td Canada Trust

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

5 Best Mortgage Calculators How Much House Can You Afford

How To Get A Mortgage Without Financially Freaking Out Mortgage Tips Freak Out Mortgage

Dailyui 004 Mortgage Calculator Mortgage Amortization Calculator Mortgage Calculator Mortgage Loan Calculator

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

5 Best Mortgage Calculators How Much House Can You Afford

Understand Your Interest Rate Land Loan Farm Loan Farm

Personal Loan Should I Take One Personal Loans Finance Loans Loan

How Much Can I Borrow For A Mortgage Rates Explained Nationalworld

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Answer To Crespo Here S How Much You Should Consider Borrowing From Your Retirement Plan To Buy A Home Allaboutmortg Video In 2022 The Borrowers Mortgage Tips Home Buying

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Pin On Money Saving Tips

Mortgage Tax Credit Recapture Mcc Nchfa Nc Mortgage Experts First Home Buyer Tax Credits First Time Home Buyers